owe state taxes illinois

A 2018 study by WalletHub found that collectively residents of Illinois face the highest tax burden in the entire country. There are only 8 states that have a.

Irs Installment Agreement Chicago Il 60647 Mm Financial Consulting Inc Chicago Internal Revenue Service Lettering

All taxpayers who are current with their tax returns are eligible to apply for a state of Illinois tax payment plan.

. It is possible to owe Illinois taxes and get a refund from your federal return in the same year. Ad Owe Over 10K in Back Taxes. The tax rates on this.

The Comptrollers Office may. Generally an installment agreement will be automatically accepted if you owe. The option to file Form IL-1040 Illinois Individual Income Tax Return without having a MyTax Illinois account non-login option is no longer available.

The State Treasurer is holding more than 35 billion dollars in unclaimed funds for Illinoisans. Corporations who owe past-due taxes may not have their corporate charters renewed. You can get general tax information by calling 1-800-732-8866 or 1-217-782.

You will owe a late-payment penalty for underpayment of. Ad Owe Over 10K in Back Taxes. The option to file.

Whether you are running a small business or trying to. When I completed my Illinois tax return I found I owe the state. The states personal income tax rate is 495 for the 2021 tax year.

The Illinois Department of Revenue or IDOR administers tax laws and collects state tax revenue. Filing your taxes just became easier. The Illinois Tax Rate.

All residents and non-residents who receive income in the state must pay the state income tax. What do I do. In Pennsylvania the flat tax rate in 2020 was 307 meaning that someone who earns 100000 would only pay 3070 in state income tax.

File your taxes stress-free online with TaxAct. The state income tax rates are 495 and the sales tax rate is 1 for qualifying food drugs and medical appliances and 625 on general merchandise. You need to print out your tax return form IL-1040 and look at line 11 net income.

Ad Over 85 million taxes filed with TaxAct. Filing your taxes just became easier. The State holds these.

Welcome to the Illinois State Treasurers. Start filing for free online now. Ad Over 85 million taxes filed with TaxAct.

Payments less than 31 days late are penalized at 2 of the amount due and payments 31 days late are. File your taxes stress-free online with TaxAct. Answers others found helpful.

The tax seems too high if you made 2068. That makes it relatively easy to predict the income tax you. Ad Owe back tax 10K-200K.

These Tax Relief Companies Can Help. Up to 25 cash back This tax is based on a businesss net income. If you bought or acquired cigarettes from another state or country for use in Illinois you also owe Cigarette Use Tax.

The state of Illinois has a flat income tax which means that everyone regardless of income is taxed at the same rate. For traditional corporations the tax is 25 of net income and for other forms of business the tax. Lottery licenses can be revoked or not renewed for nonpayment of taxes.

If you would like to file your IL-1040. Tax Help for Owed Taxes 2022 Top Brands Comparison Online Offers. To get the retirement-income tax exemption add up the retirement-plan income you reported on lines 7 8a 15b 16b or 20b of the federal Form 1040 and enter the total on Line 5 of your.

Federal and state tax laws and regulations are not the same. If it was 2068 then your tax would be 102 the. If you owe the state and are filing electronically you may pay the entire amount or make a partial payment instantly.

Start filing for free online now. Illinois sales Use Tax and Cigarette Use Tax can be paid. All residents and non-residents who receive income in the state must pay the state.

The state of Illinois has a flat income tax which means that everyone regardless of income is taxed at the same rate. The late-payment penalty amount is based on the number of days the payment is late.

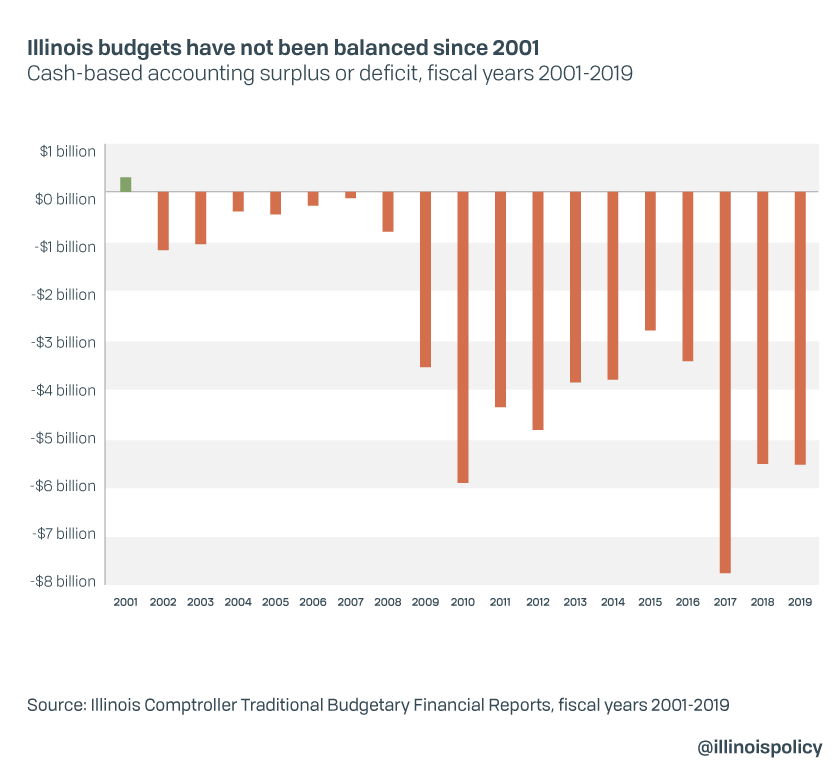

Pritzker Wrongly Claims An Illinois Budget Surplus If Not For Coronavirus

Prepare And E File Your 2021 2022 Illinois And Irs Income Tax Return

Where S My Refund Illinois H R Block

How To File And Pay Sales Tax In Illinois Taxvalet Sales Tax Done For You

Where S My Illinois State Tax Refund Taxact Blog

Failure To File Taxes Or Failure To Pay Which Is Worse In Illinois

Illinois Pritzker Promised To Lower Property Taxes He S Only Made Them Worse Wirepoints Wirepoints

Pin On Real Estate Is My Passion

Property Tax City Of Decatur Il

Graduated Income Tax Proposal Part Ii A Guide To The Illinois Plan The Civic Federation

How To File And Pay Sales Tax In Illinois Taxvalet Sales Tax Done For You

Ildeptofrevenue Ildeptofrevenue Twitter

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

The Caucus Blog Of The Illinois House Republicans Calculating Estimated State Taxes During Covid 19 Pandemic

Graduated Income Tax Proposal Part Ii A Guide To The Illinois Plan The Civic Federation

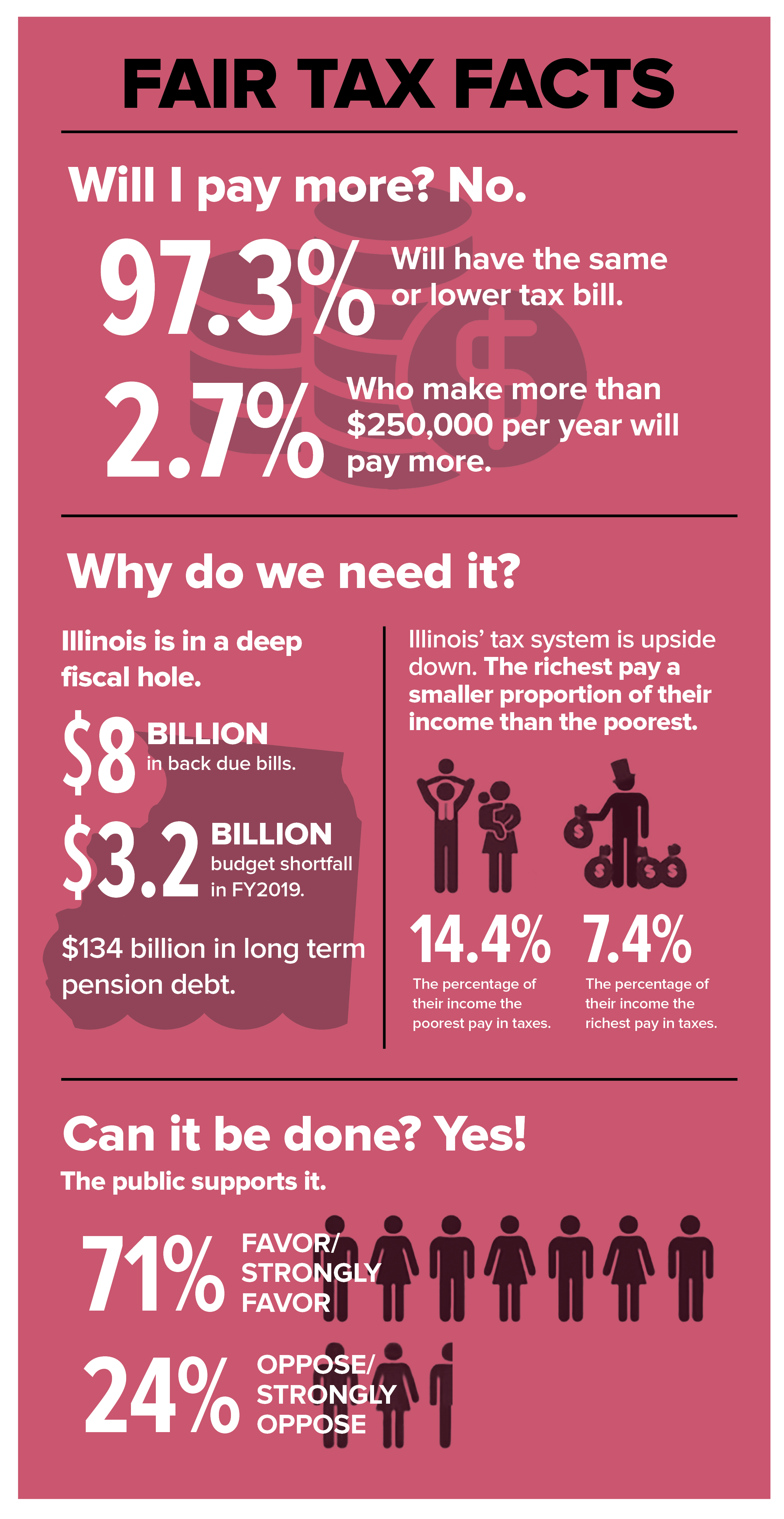

Illinois Needs Fair Tax Reform Afscme 31

Why Illinois Is In Trouble 109 881 Public Employees With 100 000 Paychecks Cost Taxpayers 14b